After a long slide, venture capital funding for medical imaging AI companies bounced back in 2025. That’s according to the latest report from market intelligence firm Signify Research.

VC funding of AI startups has declined steadily since 2020, when cheap money fueled by low pandemic-era interest rates spurred a boom in both the total dollar value of investments as well as the number of funding rounds getting done.

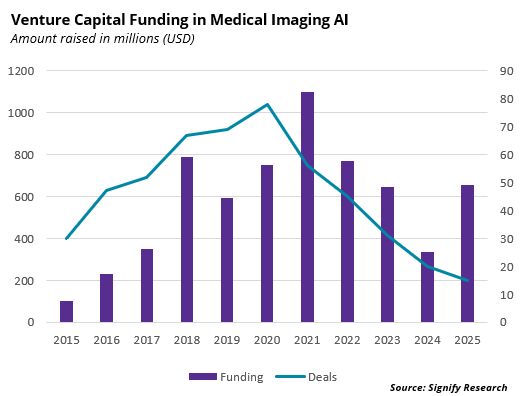

- Previous Signify reports documented the trend well, with the number of funding rounds peaking at nearly 80 in 2020 and total funding crossing the $1B mark in 2021. But by 2024, funding rounds had fallen by 64% and their dollar value by 70%.

But the numbers for 2025 show a turnaround starting, at least with respect to dollar value…

- Total funding more than doubled compared to the year before ($709M vs. $336M).

- While the number of funding rounds fell 17% (19 vs. 23).

- But the size of the average funding round grew 112% ($39M vs. $19M).

In analyzing the numbers, Signify found that while funding momentum is coming back, investors are being more selective.

- Capital is concentrating in companies that have a clear enterprise fit, a strong integration pathway, and the ability to operate within platform and imaging IT ecosystems.

Funding rounds of note in 2025 included…

- Aidoc’s haul of $150M.

- An Ultromics funding that put the company in Signify’s coveted $100M club.

- Cerebriu gaining over $10M in a Series A round.

- a2z pulling in $4.5M in seed funding for its multi-triage platform.

The report addresses turbulence in the AI platform sector, which saw significant disruption in 2025 after Bayer’s withdrawal from the market.

- Platform companies will need to move beyond AI orchestration and show they can actively improve radiology workflows and deliver better clinical decisions and measurable impact.

The Takeaway

The 2025 bounceback in VC funding for AI firms is welcome news that the correction that followed the sugar high of 2020/2021 may have worked its way through the system. AI investments in 2026 are likely to be smarter and more focused, and in companies that have demonstrated their value in helping radiologists work more efficiently.