|

UCSF Deploys | GE Pureplay

November 11, 2021

|

|

|

|

|

Together with

|

|

|

|

“Today is a defining moment for GE, and we are ready.”

|

|

GE Chairman and CEO, H. Lawrence Culp, Jr, announcing GE’s plan to split into three independent companies.

|

|

|

- GE’s Redefining Moment: After years of preparation, GE announced plans to split into three independent companies focused on healthcare, energy/power, and aviation. GE Healthcare will become the first spin-off in early 2023, creating a publicly traded healthcare giant that’s free of any constraints that might have existed while part of GE Inc. GE Healthcare’s spin-off also continues imaging’s corporate specialization trend, following the similar spin-off of Siemens Healthineers and Philips’ efforts to exit its non-health/wellness businesses.

- Ineffective Warnings: When radiologic technologists pre-read screening mammograms and alert radiologists of possible abnormalities, it might do more harm than good. That’s from a Radiology study that blinded Dutch radiologists to technologists’ abnormality “warnings” during alternating months between 2017 and 2019 (n = 53k blinded exams, 56k non-blinded). When radiologists couldn’t see these warnings, their patients had lower recall rates (2.1% vs. 2.4%) and very similar cancer detection rates (6.5 vs. 6.4 per 1k), resulting in a higher positive predictive value per recall (30.6% vs. 26.2%). The blinded radiologists’ recalls led to 19 additional cancer detections, versus just one additional cancer detection when they could actually see the warnings.

- Caption & Ultromics’ Cardiac Alliance: Caption Health and Ultromics will jointly offer Caption’s AI platform (cardiac ultrasound guidance/acquisition) and Ultromics’ EchoGo solution (cardiac ultrasound analysis), allowing images captured using Caption AI to be analyzed with EchoGo. The combined solution will also be available through Caption Health’s partnership with Butterfly Network, which should significantly expand its addressable market.

- PACS-Integrated Body Composition AI: A new study out of Germany detailed a PACS-integrated AI tool for CT-based body composition analysis, finding that it’s just as accurate and more efficient than established workflows. In a test using 20 assorted abdominal CT exams, the Visage 7-integrated AI tool detected L3 vertebra with 100% accuracy, and closely matched the tissue segmentation performance of TomoVision’s image segmentation software. The automated AI workflow was also far faster than a pair of blinded clinicians using TomoVision’s semi-automatic workflow (3 vs. 170 & 152 seconds per exam).

- Sirona’s $40m: Sirona Medical secured a $40m Series B round (total now >$60m) that it will use to fund the development and commercialization of its “disruptive” RadOS radiology operating system. RadOS unifies all radiology IT applications within a single cloud-native and AI-ready platform (worklist, viewer, reporting, AI, etc.) and can be used as an overlay to practices’ existing PACS/RIS systems, creating what Sirona views as a solution to radiology’s “fatally fragmented” infrastructure.

- Prostate MRI Disparities: A new study in JAMA revealed significant prostate MRI utilization racial disparities. Data from 795k men (>40yrs, 51.5k w/ PSAs >4ng/mL, 2011-2017) showed that black men were far less likely than white men to undergo prostate MRI within 180 days of receiving PSA scores above 4 ng/mL (24% less likely) and 10 ng/mL (-35%). The study revealed similar disparities among Hispanic men with PSA scores above 10 ng/mL (-23.4%) and Asian men with PSA levels above 2.5 ng/mL and 4 ng/mL (-26.7% & -24.1%).

- TeraRecon, a ConcertAI Company: TeraRecon announced that it is now a ConcertAI company, integrating its clinical imaging solutions with ConcertAI’s life science research solutions. The integration will apparently start with bringing TeraRecon’s imaging solutions into ConcertAI’s research workflows and clinical trial network, leading to their longer term strategy to create a multi-modal AI platform (EMR, genomic, imaging) that supports both life science research and clinical decision making. Although not necessarily expected, this move makes sense given that TeraRecon and ConcertAI are both owned by SymphonyAI, and considering the companies’ short-term synergies and long-term potential.

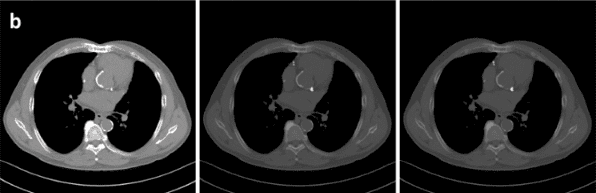

- Diagnostic CT Drop-Outs: When patients in lung cancer screening programs are referred for a follow-up diagnostic chest CT they are more likely to drop-out of the program. Brigham and Women’s Hospital researchers analyzed data from 5,912 patients who underwent LDCT screening between 2011 and 2018 (1,240 w/ ≥3 exams), finding that patients who underwent subsequent LDCT screenings (82% retained) were far more likely to remain in the screening program than patients who underwent subsequent diagnostic CT exams (39% retained).

- Nanox Completes Zebra & USARAD Acquisitions: Nanox completed its merger with Zebra Medical Vision and its acquisition of USARAD Holdings. Zebra-Med immediately becomes Nanox.AI, serving a key role in Nanox’s end-to-end radiology platform strategy along with USARAD’s network of teleradiologists and the Nanox.ARC scanner. Meanwhile, Nanox.AI will continue to pursue its population health AI strategy.

- Female Rad Accuracy: A new JACR study of 213 Europe-based radiologists revealed that female rads make fewer diagnostic errors than their male colleagues, and shared several reasons why this might be the case. Female radiologists in the study had a 4.4% median error rate (vs. 5.2% w/ men), potentially because they often had a narrower scope of practice (75% reported cases from one specialty vs. 59% of males), requested more second opinions (2.4 per 1k reports vs. 0.8 w/ men), and read cases at a slightly slower pace (7.4 RVUs per hour vs. 8.3 w/ men).

- Rad AI’s $25m: Unique radiology AI startup, Rad AI, completed a $25m Series A round (total now ~$35-$40m) that it will use to further develop and commercialize its products for reporting automation (Rad AI Omni) and incidental follow-ups (Rad AI Continuity). Rad AI might not get the same headlines as many pixel-focused radiology AI firms, but its operational value proposition has earned it installations at 7 of the 10 largest private radiology practices in the US.

- HeartVista’s Siemens CMRI FDA: HeartVista’s One Click Cardiac MRI software now has FDA 510(k) clearance for use with Siemens Healthineers MRI scanners. The software uses AI-guided image acquisition to prescribe standard cardiac views, notifies operators if artifacts or low image quality is detected, and streamlines a range of CMR procedures. HeartVista emphasized how the software lowers cardiac MRI adoption barriers (faster exams, less tech training, less discomfort), which is especially relevant given CMR’s role in the new chest pain recommendations.

|

|

- After more than 15 years of development, the world’s first photon-counting system is here to redefine CT. Register now and join Siemens Healthineers at the launch event on November 18 to be part of this quantum leap forward in technology.

- See how ED physicians at France’s Hospital of Maubeuge reduced emergency imaging error risk by 75% using Arterys Chest MSK.

- Learn how Yale New Haven Health improved its radiology efficiency, communications, and turnaround times when it adopted Nuance’s PowerScribe Workflow Orchestration and PowerConnect Communicator solutions.

- It says a lot when a solution works so well for a radiology department that they decide to perform a study to quantify its benefits. In this Imaging Wire Q&A, University Hospital of Zurich’s Thomas Frauenfelder discusses his experience and study on Riverain Technologies ClearRead CT.

- Rising CT volumes and related costs are creating new pressures on CT teams, but these trends can be corrected through greater communication, education, and awareness. See how in this new GE Healthcare report.

- CD burning issues? Check out this one-minute video showing how Novarad’s CryptoChart image sharing solution allows patients to easily access and share their medical images using personalized, highly secure QR codes (not CDs).

|

|

|

|

|